Retirement Matters

March 2023

Debt Ceiling Limit — Last month’s SERA-Nade discussed how the 2023 GOP-controlled U.S. House of Representatives is insisting on steep cuts to Social Security and Medicare, in exchange for their vote to increase the U.S. debt ceiling. But the U.S. Treasury may be able to keep sending out retirees’ Social Security benefit checks and Medicare payments, if the borrowing cap isn’t raised in time, under an obscure 1996 law that allows for Social Security and Medicare trust funds to be drawn down to keep benefits flowing until the debt limit is raised. However, it may not be easy as it’s technically difficult to prioritize payments.

Staying Vigilant — Social Security and Medicare cuts have been proposed based on the assertion that they are going bankrupt. Yet these programs are not insolvent. The most recent annual Social Security trustees report illustrates that Social Security has a $2.85 trillion surplus in its trust fund. This would allow it to pay 100 percent of benefits through 2035, 90 percent for the next 25 years, and 80 percent for the next 75 years. Instead of remaining silent, each one of us should be ever vigilant to shift the focus towards strengthening these programs quickly, as the cost of solutions gets more expensive when they’re delayed.

Social Security Expansion Act — This legislation, introduced by Sanders (I-Vt.) and Warren (D-Mass.) in the Senate and by Reps. Jan Schakowsky (D-Ill.) and Val Hoyle (D-Ore.) in the House, would ensure the program is fully funded through 2096 and put an additional $2,400 in beneficiaries’ pockets annually. The bill would increase the cap on the maximum income subject to the payroll tax from $160,200 to $250,000. This would not raise taxes on 93 percent of the U.S. households making $250,000 or less per year because few Americans earn between $160,000 and $250,000, according to an analysis by the Social Security Administration.

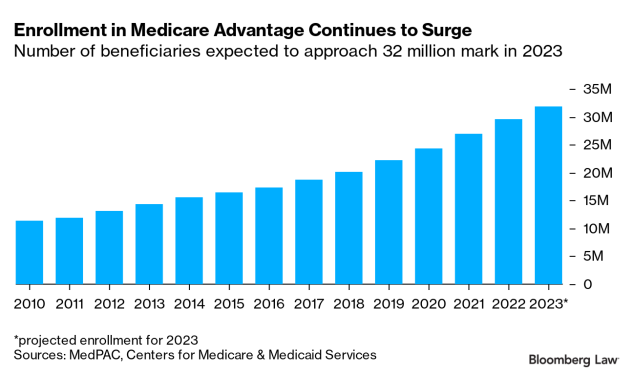

Medicare Advantage (MA) at 50% — The State of Michigan has chosen to enroll State employee retirees, within the defined benefit plan, in a MA plan, rather than the traditional Medicare plan. MA plans nationwide are reaching an estimated 32 million beneficiaries in 2023 as the chart shows. This growth is projected to exceed more than half of the Medicare plans this year. MA plans spend more than traditional Medicare on patients with similar medical conditions. MA’s higher cost and expanding enrollments are driving up the long-term cost of Medicare, when Medicare funding is projected to have a shortfall by 2028. As the MA plans grow, as a share of the national total, their spending policies are having a greater impact on Medicare funding.

Prior Authorization — MA plans usually require prior authorization to get approval of a health care service or medication before the care is provided. It determines whether the care is medically necessary and covered. Prior authorization is used as a tool to limit spending and stop people from receiving unneeded services. But it also creates barriers, delays, and complexity in getting necessary medical care. Traditional Medicare plan enrollees are only required to get prior authorization for a limited type of service. But, virtually all (99 percent) of MA plans require prior authorization for some services in 2022. For example, most higher cost services, such as chemotherapy or skilled nursing, require prior authorization. This practice helps MAs to cut costs and keep profits.

National MA Trends — This article is about national trends in the MA plans. Each individual MA plan may have its separate prior authorization policy. We may be experiencing better care with our State of Michigan MA plan than national trends and that’s something we should be thankful for. Hopefully it continues. However, it’s important for our retirees to know that medical costs are rising while policy makers are considering reductions to Medicare funding. MAs are private sector plans which mean their goal is to make profits first. Studies have shown that MAs nationwide are using prior authorization policies to reduce the medical care they provide and to increase profits.

Treatments Denied — Unlike traditional Medicare, MA plans rejected 6 percent of prior approvals. In 2021, of the more than 35 million requests that were submitted by doctors to MAs, about 2 million were fully or partly denied, according to the Kaiser Family Foundation report on 500 MA plans. Most of these denials were not challenged, which isn’t surprising given the doctor shortage and the lack of staffing to prepare an appeal. However, when about 11 percent of the total denials were appealed, a vast majority (82 percent) were successful in providing a full or partial treatment. This high rate of reversals, upon appeal, brings up the question of whether a larger portion of the denials should have been approved in the first place. The American Medical Association reports that about one-third of doctors say that the long and complex process has resulted in a serious adverse medical event for their patients. MAs are not required to give a reason for denials, so it’s difficult to appeal the denial.

Federal Enhancements — In 2022, the U.S. House passed H.R. 3173 requiring MAs to establish an electronic process for real-time prior authorization decisions, but it did not pass the U.S. Senate. This need for real time decisions addresses the concern that if approvals are not made in a timely manner, they become denials by default. In the meantime, the Centers for Medicare and Medicaid Services (CMS) are considering rules to enhance the use of the electronic system, along with timeliness and transparency in decisions. The CMS rules spell out the criteria that MAs may use for prior authorizations and time-period for which approvals are valid.

Keeping the Lights On — Rising utility costs negatively affect retirees on a fixed income. Recently, DTE requested an annual $622 million in revenues. The Michigan Public Service Commission (MPSC) rules on DTE’s utility rate increase requests. DTE has recorded 7,000 more outages and over 350,000 more customers with no power compared to the Board of Water and Light which is a municipal and public owned utility. In mid-February, more than 700,000 Michiganders were without power. Resolving the power outage was difficult given the severity of the ice storm and population density. The Senate Energy and Environment Committee, chaired by Sen. McCann (D-Kalamazoo), was briefed on why the power was out from Consumers Energy and DTE Energy and are looking into policy changes for legislative action. DTE has been criticized for the billions in rate increases since 2010 along with political spending, campaign contributions, and lobbying. A Michigan “ratepayers bill of rights” is proposed for utilities that would prevent them from making political contributions and restricting rate increase requests to those based on yearly performance.

Editor’s note: Joanne Bump serves as feature columnist for “Retirement Matters.” Column content is time sensitive and is based on information as of 3/5/23. Joanne can be contacted by e-mail at joannebump@gmail.com.

Return to top of page