Retirement Matters

February 2022

Debt Ceiling — You may have heard about the debt ceiling controversy on the news but are interested in how it could affect retirees. The debt ceiling was already reached on January 19, 2023, the federal government having spent up to the limit of $31.4 trillion. To buy time until June 2023, the federal government is still managing to pay its bills, with work arounds that stall the impact of not raising the debt limit. When revenues aren’t enough to cover spending, the U.S. Treasury borrows what is needed. However, a fixed dollar limit is set on borrowing. When the debt limit is reached, it creates a conflict until Congress either raises or suspends the debt limit. Defaulting on the U.S. debt would create a crisis, not only by reducing your benefits, but by potentially spurring a global economic recession. Even the threat of a default may dampen the economy until it’s resolved.

Default — If Congress doesn’t increase or suspend the debt limit, meaning that it cannot uphold its financial obligations, a default would occur and Social Security and Medicare benefits could be disrupted. Raising the debt ceiling doesn’t increase spending, it just lets government pay for expenditures already approved by Congress. It’s a self-imposed limit which could be repealed.

Why a Crisis Now? — It’s an admirable goal to reduce the deficit, but it isn’t easy to do. Over the next decade, an estimated 26 percent cut to the federal budget is required to balance the budget. During the Trump administration, the debt ceiling was raised without much resistance. Nonetheless, the 2023 GOP-controlled U.S. House of Representatives is now insisting on steep cuts to federal spending, although they have not said what programs they want to reduce. However, don’t be misled into thinking that these cuts will not impact seniors given that Social Security and Medicare are the largest categories of spending, and solutions that include tax increases are off the table.

The Math Does Not Add Up — Sixty-two percent of the total federal government spending is on entitlements that you may qualify for based on age or income. From total federal spending, Social Security is 22 percent, Medicare is 17 percent, and Medicaid is 10 percent. Medicaid provides health insurance for those with low incomes. While seniors may not think of themselves as having a low income now, it becomes important to them later. Many seniors rely on Medicaid as a primary source of paying for nursing home care, as they age and eventually spend down their assets on long-term care.

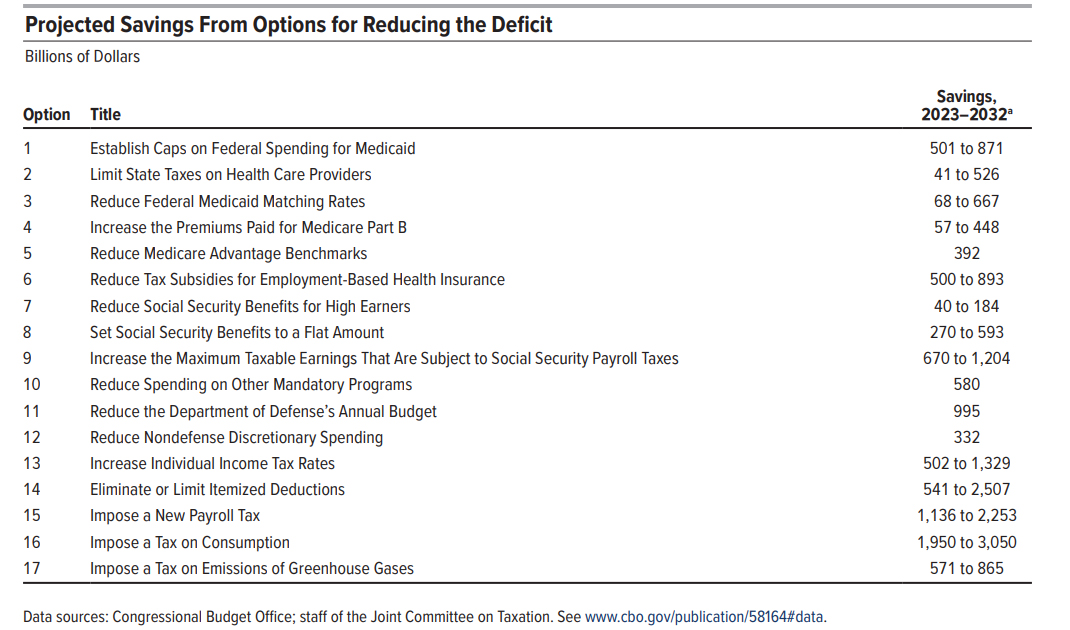

Payroll Tax — So how much do state employees contribute to these benefits? State employees and their employer each pay a combined Social Security and Medicare payroll tax of 7.65 percent on up to $160,200 in 2023 (the payroll tax cap). But the earnings of most state employees don’t even get close to the $160,200 cap. However, many wealthy persons reach this cap by February of every year. There are many proposals for solving the budget shortfall. See the chart showing the ten-year financial savings of deficit reduction options, some of which would cut benefits and raise taxes. Instead of reducing benefits for seniors, several proposals have called for raising revenue to more fully fund the benefits. However, they haven’t had enough votes to surpass the 60-vote filibuster needed for passage in the U.S. Senate

Payroll Tax Cap — One of the largest revenue raisers that partially reduce the deficit is increasing the cap on payroll taxes to capture revenue from the highest earners (see number 9 in the table). This plan leaves the average retiree unharmed. Increasing the maximum taxable earnings subject to the Social Security payroll taxes could reduce the deficit between an estimated $670 and $1,204 billion dollars.

(click for larger image)

Tax Cuts — Growth in entitlement programs isn’t the only significant factor contributing to the deficit. In 2017, the Trump Administration added $1 to $2 trillion to deficits over ten years with tax breaks for mostly wealthy people and large corporations. If these tax breaks are renewed, it will further add to the deficit. But the GOP isn’t signing onto legislation to raise revenue. Instead, they are calling for budget cuts.

Stay Informed — As the debt limit debate continues, stay tuned for news on reforming Social Security, Medicare, and Medicaid. It’s time to prioritize educating yourself, family, and friends on whether your representatives in Congress are acting in your financial best interest and let your support for fully funding these programs be known.

Pension Update — In February, Jon Braeutigam, Chief Investment Officer of the Bureau of Investments, Michigan Department of Treasury, addressed retirees at the SERA Lansing Chapter membership meeting. He provided some status updates on the Michigan State Employees’ Retirement System (MSERS)

- MSERS recorded 66,836 total members as of September 30, 2022. Since this pension plan was closed by law to new members in 1997, with no new entrants since then, most members are already receiving pensions. Of the total, 60,174 retirees and beneficiaries are receiving benefits, 4,762 current employees are vested, 23 current employees are not vested, and 1,877 inactive entitled employees are not yet receiving benefits.

- As of fiscal year 2021, the MSERS funded actuarial ratio was 69.1%, an increase from 65.6% in fiscal year 2020.

- On December, 31, 2022, the market value of all major funds in MSERS reached $20.3 billion, the second largest plan below the Public-School Employees Retirement System.

Public Service Commission (PSC) — Recently, the PSC approved a slight percent increase on Consumers Energy customers’ monthly bills under an agreement that permits a $155 million rate increase. This change is 43 percent lower than the $272 million originally requested by the utility. Also, the PSC is holding hearings in March on a proposal to add 679 as a new area code for Detroit and its suburbs given that the 313 area code is running out of numbers to assign to customers.

Editor’s note: Joanne Bump serves as feature columnist for “Retirement Matters.” Column content is time sensitive and is based on information as of 2/5/23. Joanne can be contacted by e-mail at joannebump@gmail.com.

Return to top of page