Retirement Matters

December 2022

The Stars Align — Over the past decades, the thought of driving over Michigan roads free from potholes has been music to our ears, if not to our car repairs. But, fixing the roads has seemed nearly impossible for decades. Michigan’s GOP-led Legislature didn’t enact Governor Whitmer’s 2019 proposed 45-cent motor fuel tax rate hike. A new tax plan will have an easier time getting through the Democratic-led Legislature, starting in 2023. As a stopgap to fix the roads, Governor Whitmer issued $3.5 billion in bonds over five years through the Rebuilding Michigan plan as part of her executive power in 2019. Bonding was a short-term solution. More ongoing revenue is needed because when bond revenue finally runs out, it creates debt service costs. Also, bonds can only be used to repair State trunklines; that includes all State highways but not local roads. Governor Whitmer says a new approach with a broad base of public support is needed.

Revenues Down — There are two taxes on motor fuel: 1) a tax per gallon and 2) a sales tax on the total purchase price. Part of the sales tax on motor fuel isn’t available for maintaining roads because about 73 percent is distributed to the School Aid Fund, financing K-12 schools, and 10 percent goes to cities, villages, and townships as reported by the Citizens Research Council (CRC). The gas tax revenue is already declining and will get worse as the percentage of electric vehicles rises. The 10,600+ Michigan electric vehicle (EV) drivers aren’t paying the gas tax at the pump now but user fees are being considered like (1) a tax based on the miles driven or (2) a fee for use of EV charging stations. Michigan’s tax per gallon is set to increase a slight 1.4 percent in 2023 as part of an inflationary increase included in the 2015 road funding package.

COVID Surplus — Now is the time to act, as all the stars may be in alignment to finally get the roads fixed. What gives us hope for roads less littered with potholes is the Michigan COVID surplus. Prior fuel tax reform ideas haven’t worked because they created an unfunded budget hole. The COVID surplus didn’t get pulled out of thin air but came from President Biden’s federal aid policies like the COVID relief checks that boosted consumer spending leading to more sales tax revenue. Also, the Coronavirus Aid, Relief and Economic Security Act (CARES Act), the America Rescue Plan Act (ARPA), and the Inflation Reduction Act (IRA) provided billions in federal aid in 2021 and 2022.

Tax Shift — According to CRC, Michigan could remove the sales tax on motor fuel and substitute it with a revenue-neutral increase in the motor fuel tax rate by using the COVID surpluses to fill in the budget shortfall from the tax shift. Keeping gas prices at the pump the same, consumers would pay less sales tax and more motor fuel tax for gasoline. The tax shift has been supported by both political parties in the past. And, the public has supported ensuring that all taxes at the pump go to road maintenance. The CRC outlined their backfill calculations based on a Senate Fiscal Agency (SFA) analysis of the current annual surplus. In July 2022, the State had about $7 billion in total reserves. After reviewing baseline spending and known spending pressures, a combined $2.5 billion will be available in Fiscal Year 2024 for some combination of new ongoing spending or permanent tax relief. The tax policy change would:

- Generate over a billion dollars in new dedicated transportation funding and fill in budget shortfalls with the COVID surplus.

- Help local agencies, left out of the Rebuilding Michigan bonding plan, with more funding.

- Leave enough general fund financing for Governor Whitmer’s tax relief for retirement income and to improve Michigan’s Earned Income Tax Credit (EITC). This credit was reduced from 20 percent to 6 percent of the federal credit to finance Governor Snyder’s business tax cut a decade ago.

- Fund another $3.5 billion in one-time funding for economic development incentives and a recession fund.

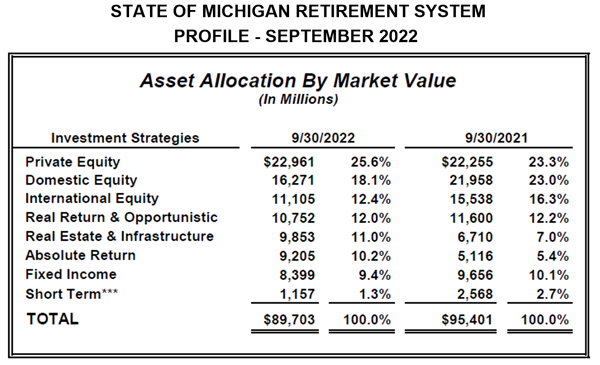

Pension Trends — The State of Michigan Investment Board (SMIB) met December 8 for its Quarterly Investment Review of the State of Michigan Retirement System. The Michigan State Employee Retirement System (MSERS) makes up 19.9 percent of Michigan’s combined pension plans. See the chart below for a comparison of changes in the asset allocation by investment class which is heavily invested in equities.

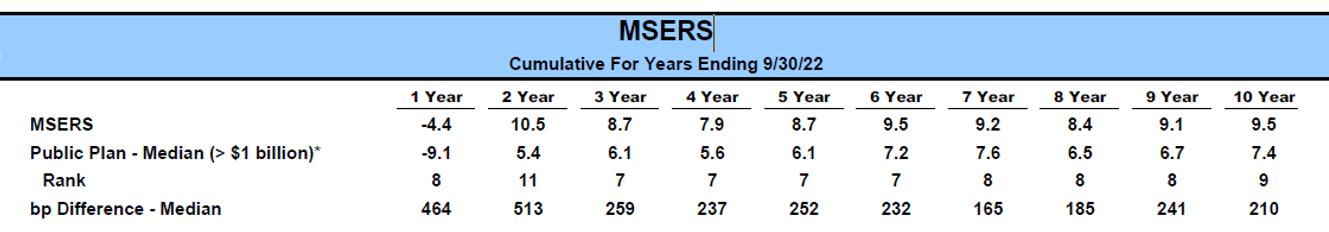

Rate of Return — The long-term market rate of return, or the annual income from an investment as a percentage of the initial investment, has been strong. See the chart below with the MSERS cumulative total fund return. Over the last ten years, the return on assets was 9.5 percent with consistent returns of nearly 8 percent for nine out of ten years. However, the last one-year return was -4.4 percent, which out-performed its peers median public plan performance of -9.1 percent. The mix of assets are managed by SMIB within the current low return environment and provide enough cash on hand to pay out pensions.

Energy Rates Up — The Public Service Commission (PSC) recently approved a $35 million electric rate increase for DTE Energy Company, impacting over 2.3 million customers, with a 71-cent monthly rise for typical residential customers. This increase provides DTE with a 9.9 percent return on common equity and a 5.42 percent return overall. The PSC reined in DTE’s request for a $388 million increase, rejecting DTE’s forecast of reduced electric demand and instead noted that demand was up in 2020 and 2021.

Coal Plants Shuttered — In November, DTE Energy announced its plan to phase out the last coal-fired power plants and stop using the substance to produce energy by 2035. This would substitute nearly 40 percent of the current energy mix with other sources by retiring its remaining coal-fired power plants earlier. This Integrated Resource Plan would move up the retirement of the Belle River Power Plant from 2028 to 2026 and start the phasing out of the Monroe Power Plant in 2028 rather than 2040.

Editor’s note: Joanne Bump serves as feature columnist for “Retirement Matters.” Column content is time sensitive and is based on information as of 12/11/22. Joanne can be contacted by e-mail at joannebump@gmail.com.

Return to top of page