Retirement Matters

September 2022

Lower Drug Prices — The Inflation Reduction Act (IRA), just enacted last month, is a historic legislative victory for seniors. Its importance is substantial and can’t be over stated. It finally provides Medicare with the authority to negotiate prescription drug prices which will have unprecedented impact on heading off the insolvency projected for Medicare. Medicare funding is projected to become insolvent by 2028, just six years from now, according to a 2022 Medicare Trustees report. Insolvency doesn’t mean that Medicare has completely run out of money or would not be able to pay out claims, but rather that it may not have the financing to pay 100 percent of its expenses. Benefits could be reduced. This projected insolvency has been used as an unjustified rationale for future benefit cuts.

Revenues Up More Than Research — Since 2003, when the Medicare Part D drug program was established, Medicare was prevented by law from acting in the best interest of seniors and taxpayers to lower drug costs. In frustration, you may ask, why wasn’t this done sooner? The pharmaceutical industry has blocked Medicare from lowering their drug costs for many years, arguing that profits made from these drugs were needed to pay for the research for new cures. But studies don’t verify their claim. Increases in drug company revenues are used for more than research. According to USC-Brookings Schaeffer Initiative for Health Policy, between 2000 and 2018, net revenues from the largest 27 pharmaceutical companies increased by 240 percent, from $300 billion to nearly $725 billion. At the same time, their research and development spending, as a percentage of net sales, rose only modestly from 12 percent to 17 percent. Finally, drug companies benefit from the basic discovery research that is primarily funded by government and philanthropic groups. Pharmaceutical companies and venture capitalists usually finance later stages of drug development.

Taxpayer Savings — Medicare is estimated to save $288 billion through 2031 without cutting benefits, according to The Congressional Budget Office. These savings could also free up funds as an installment toward providing vision, dental, and hearing benefits. State employees receive the benefits through Medicare Advantage, but they are not yet available to those in the traditional Medicare program.

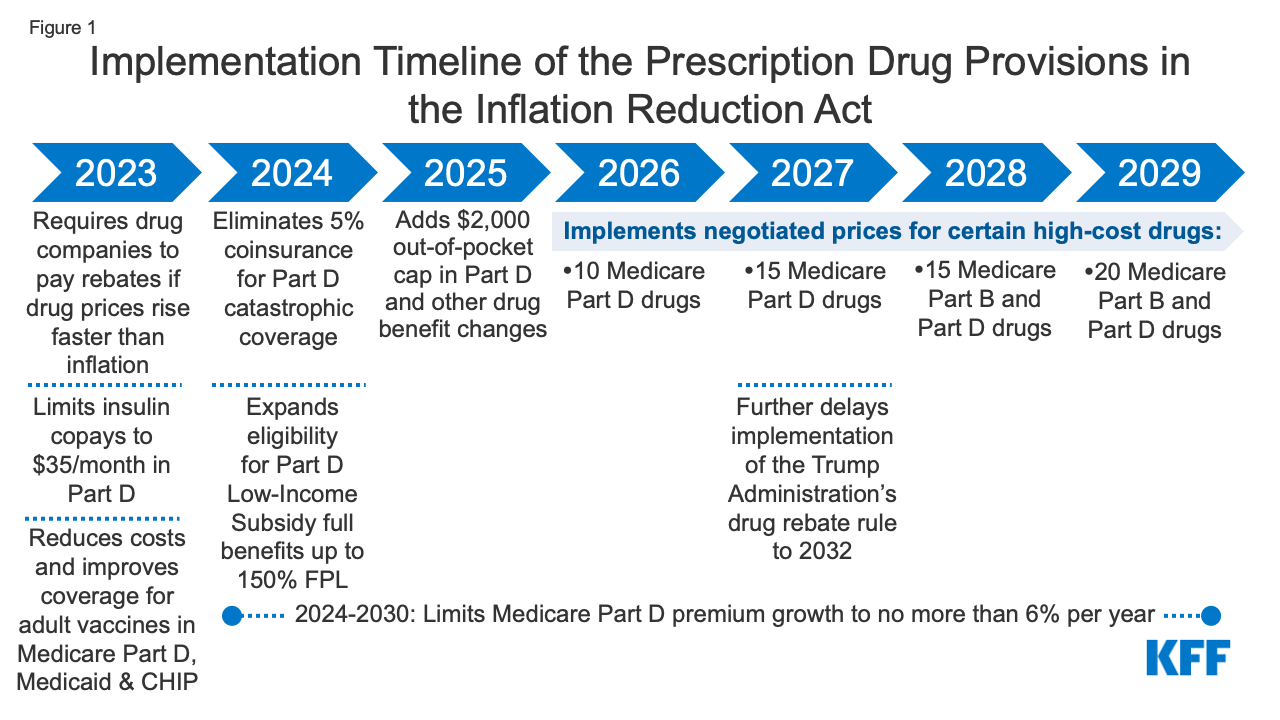

Floodgates Open — The administration would have preferred that more drugs be subject to negotiation earlier, and to achieve savings much faster. But compromises were necessary to lower the cost as a way to get the votes required for passage. As the chart shows, the implementation is staggered over a number of years, with only a small number of drugs that can be negotiated each year. The plan is to negotiate the most expensive and financially burdensome drugs first. The important point is that the decades-long dam has finally broken. This is the beginning of an era where drug prices can be negotiated and future savings will be achieved as long as there is the will to support it. Having affordable access to prescription drugs can enhance the lives of seniors. Your voting power is crucial to ensure that retiree’s interests are heard. See the Keiser Family Foundation (KFF) chart that illustrates the key provisions that help to lower drug costs.

Credit Rating Up — Michigan’s strong financial position, prudent fiscal management, and economic growth have encouraged Fitch Ratings to increase Michigan’s credit rating from AA to AA+ with a stable outlook. An increase like this is hard to come by and it is the first Fitch upgrade since 2013. Fitch is one of the three top credit rating agencies that rates the viability of investments relative to the likelihood of default. Fitch mentioned Michigan’s sound financial management practices, like increasing the State’s rainy-day fund up to $1.6 billion, expanding cash balances, and maintaining structural balance, as justifications for the rate boost. Michigan’s strong credit rating will save taxpayers money by lower borrowing costs for upcoming bond issues.

Cost of Living Adjustment (COLA) — As retirees struggle with higher inflation, their Social Security (SS) payments are likely to get a major boost starting in January of next year. The COLA formula is based on inflation recorded for July, August, and September of 2022. Inflation increased by 8.5 percent this July even as gas prices and airfares declined. July’s Consumer Price Index (CPI) increase compared with a 40-year high of 9.1 percent in June, which may have been its peak. Record levels continued for August and September, which were still much higher than in the past. The Senior Citizens League estimates a 9.6 percent increase for SS COLA in 2023, the largest increase since 1981. Look for the actual COLA increase which is expected to be announced around October 13, after the October CPI data is released.

Affordable Internet Access — Internet access is essential for many aspects of our daily lives. But affordable high-speed internet is out of financial reach for many, including some retired State employees or their families. Tell your friends about the Affordable Connectivity Program (ACP) which reduces the cost of Internet access for people with limited incomes. Check eligibility if your household income is 200 percent or less than the federal poverty guidelines or someone in your household is covered by certain government assistance programs. If one qualifies, discounts include: $30 off per month towards Internet service, $75 per month for households on qualifying Tribal lands, and up to $100 toward a computer or tablet.

Required Minimum Distributions (RMDs) — This is a reminder for retirees with retirement savings accounts. It’s time to review the tax rules, learn more, and plan ahead. To name just a few rules, federal law requires you to withdraw a minimum amount from most retirement savings accounts each year at age 72. For subsequent years, you must withdraw your RMD amount from your plans by December 31 of each year. This includes the year after you turn age 72, even if you take your first withdrawal that year. These withdrawals are determined separately for each of your retirement plans, like your 401(k) or 457 plans, and are required for each individual, not jointly as a couple.

Editor’s note: Joanne Bump serves as feature columnist for “Retirement Matters.” Column content is time sensitive and is based on information as of 9/11/2022. Joanne can be contacted by e-mail at joannebump@gmail.com.

Return to top of page