Retirement Matters

January 2022

Outstanding news for your pension investments, utility savings, and Medicaid long-term home care.

Investments Reviewed — The State of Michigan Investment Board (SMIB) met virtually on December 9 for its quarterly review of the most recent period ending on September 30, 2021. The SMIB is housed in the Department of Treasury and, as your fiduciary, will act in your best interest as the investor. The Michigan State Employee Retirement System (MSERS) is included within State of Michigan Retirement Systems (SMRS), along with other Michigan public pension plans. SERA tracks the performance of these investments because nearly two-thirds of State retirees’ pension payments come from investments, with a smaller share contributed by the employer and employee. What news from the SMIB meeting is important for our readers?

Pension Return up 27.8% — Your State employees retiree investment return increased by 27.8 percent for the year ending September 30, 2021. Despite the negative economic news you may hear, it’s time to pivot and rejoice. Consider counting your blessings because this outstanding growth rate is something to cheer about. More importantly, the ten-year MSERS return was up 11.4 percent on an annualized, cumulative ten-year period. This compares to public plan peer returns of 10.1 percent. The long-term return is significant because it’s what the pension system depends on, and its growth was also strong. This was a great ten-year return as declining interest rates helped the equity and bond markets. State employee retirees will reap the benefits from these returns by more fully funding and stabilizing the plan. Like most states, Michigan has not completely funded the public pension systems.

Investment Goals — Asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolio’s assets according to an individual’s goals. Likewise, the SMRS invests within their stated goals of maintaining enough liquidity to pay benefits and meet or exceed the actuarial assumption over the long term. The objective is to perform in the top half of the public plans over the long-term time period. The last objective is to diversify assets toward reducing risk and exceeding individual asset class benchmarks over the long run.

Low Return Environment — In total, the SMRS market value reached $95.4 billion, the largest amount in its history, as of September 30, 2021. This was an increase of $19 billion from $76.4 billion as of September 30, 2020. This growth provides a positive position to be in as Michigan investors face the challenge of reaching investment goals within a low-return environment over the next few years. Greater risk must be assumed to meet these goals.

Liquidity — It’s defined as the time and cost it takes to convert an investment into cash, and is another basic risk expected and managed through asset allocation. Pension funds need a planned amount of liquidity to pay out benefits. The plans hold approximately $15.8 billion in non-liquid assets, mostly in private equity. In the June 2021 quarter, $1.6 billion of new commitments were made.

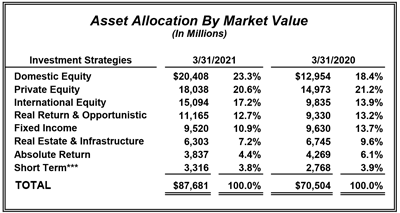

Pay Outs — These combined systems paid out about $1.65 billion, net of contributions, over the past twelve months ending September 30, 2021. Over the past year the allocation was lowered as follows: Private Equity by $1.05 billion; Real Estate by $243 million; long-term fixed income by $112 million; Real Return and Opportunistic by $72 million; Short Term Cash by $21 million; and Domestic Equity by $18 million. At the same time, the allocation increased to International Equity by $65 million and to Absolute Return by $842 million. The goal of the Absolute Return asset class is to diversify the total plans holdings, by targeting returns above investment-grade fixed income while also continuing lower volatility, and unwanted risk. The value of the Absolute Return asset class reached is $5.1 billion with a one-year return of 15.6 percent as of September 30, 2021.

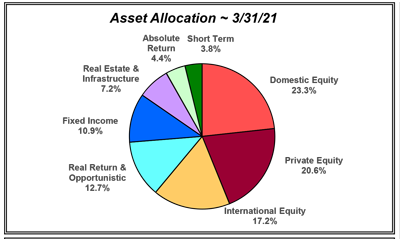

Asset Allocation — The most recent asset allocation for the combined retirements plans or SMRS as of September 30, 2021, are shown in the pie chart and table below. The asset class percent of portfolio is nearly the same for each retirement system so it also represents the MSERS asset allocation. Growing asset classes include the Private Equity and Domestic Equity that grew as a percentage of the portfolio. Private Equity is the largest asset class at 23.3 percent. The Private Equity returns usually lag during the expansion and lead during a contraction and was reduced by $1.05 billion last year. Private equity is expected to remain healthy if the economic expansion continues.

2021 Asset Allocation for State of Michigan Retirement System

2021 Change in State of Michigan Retirement System Asset Allocation

Lower DTE Gas Rates — With Michigan’s good government oversight, DTE gas customers will save more than $111 million from the proposed rate increase. (DTE is the stock symbol for the former Detroit Edison company.) Due to the recommendation of the Michigan Attorney General (AG) Dana Nessel and the Michigan Public Service Commission (MPSC), the final rate was cut by 57 percent off from the $195 million originally requested. AG Nessel argued the request was excessive and unreasonable and that the annual increase should not be more than $19 million for a revenue deficiency. Added revenue was provided to continue improving its infrastructure and customer experience. The January 1, 2022, rate increase for the average residential customer will amount to about 3.7 percent more or $3.18 per month. The Citizens Utility Board (CUB) of Michigan supported the AG’s recommendation.

Medicaid Home Care — The November 2021 SERA-Nade reported on the President’s Build Back Better bill that recommended a slimmer $150 billion nationwide for a Medicaid expansion of the Home and Community Based Services (HCBS). This would finance those preferring to remain in their homes for long-term care. It’s time to review and provide an update. The legislation has been stalled in Congress. However, in December, the Centers for Medicare and Medicaid Services (CMS) relaxed some financial eligibility standards so more could qualify, including disregarding specified amounts of the individual’s income or resources. The disregard applies only to specific HCBS programs or benefits, but not nursing homes, making it less expensive.

Editor’s note: Joanne Bump currently serves as feature columnist for “Retirement Matters.” Joanne can be contacted by phone at (517) 896-2729 or by e-mail at joannebump@gmail.com.

Return to top of page